Updated 1/16/2018

HPE expanded its Storage I/O Data Infrastructures portfolio buying into server storage I/O data infrastructure technologies announcing an all cash (e.g. no stock) acquisition of Nimble Storage (NMBL). The cash acquisition for a little over $1B USD amounts to $12.50 USD per Nimble share, double what it had traded at. As a refresh, or overview, Nimble is an all flash shared storage system leverage NAND flash solid storage device (SSD) performance. Note that Nimble also partners with Cisco and Lenovo platforms that compete with HPE servers for converged systems.

Earlier this year (keep in mind its only mid-March) HPE also announced acquisition of server storage Hyper-Converged Infrastructure (HCI) vendor Simplivity (about $650M USD cash). In another investment this year HPE joined other investors as part of scale out and software defined storage startups Hedvig latest funding round (more on that later). These acquisitions are in addition to smaller ones such as last years buying of SGI, not to mention various divestitures.

What Are Server Storage I/O Data Infrastructures Resources

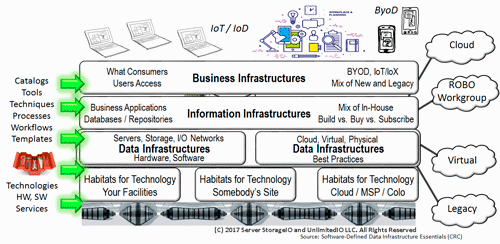

Data Infrastructures exists to support business, cloud and information technology (IT) among other applications that transform data into information or services. The fundamental role of data infrastructures is to give a platform environment for applications and data that is resilient, flexible, scalable, agile, efficient as well as cost-effective.

Technologies that make up data infrastructures include hardware, software, cloud or managed services, servers, storage, I/O and networking along with people, processes, policies along with various tools spanning legacy, software-defined virtual, containers and cloud.

HPE and Server Storage Acquisitions

HPE and its predecessor HP (e.g. before the split that resulted in HPE) was familiar with expanding its data infrastructure portfolio spanning servers, storage, I/O networking, hardware, software and services. These range from Compaq who acquired DEC which gave them the StorageWorks brand and product line up (e.g. recall EVA and its predecessors), Lefthand, 3PAR, IBRIX, Polyserve, Autonomy, EDS and others that I’m guessing some at HPE (along with customers and partners) might not want to remember.

In addition to their own in-house including via technology acquisition, HPE also partners for its entry-level and volume low-end MSA (Modular Storage Array) series with DotHill who was acquired by Seagate a year or so ago. In addition to the MSA, other HPE OEMs for storage include Hitachi Ltd. (e.g. parent of Hitachi Data Systems aka HDS) reselling their high-end enterprise class storage system as the XP7, as well as various other partner arrangements.

Keep in mind that HPE has a large server business from low to high-end, spanning towers to dense blades to dual, quad and cluster in box (CiB) configurations with various processor architectures. Some of these servers are used as platforms for not only HPE, also other vendors software defined storage, as well as tin wrapped software solutions, appliances and systems. HPE is also one of a handful of partners working with Microsoft to bring the software defined private (and hybrid) Azure Stack cloud stack as an appliance to market.

HPE acquisitions Dejavu or Something New?

For some people there may be a sense of Dejavu of what HPE and its predecessors have previously acquired, developed, sold and supported into the market over years (and decades in some cases). What will be interesting to see is how the 3PAR (StoreServ) and Lefthand based (StoreVirtual) as well as ConvergedSystem 250-HC product lines are realigned to make way for Nimble and Simplivity.

Likewise what will HPE do with MSA at the low-end, continue to leverage it for low-end and high-volume basic storage similar to Dell with the Netapp/Engenio powered MD series? Or will HPE try to move the Nimble down market and displace the MDS? What about in the mid-market, will Nimble be unleashed to replace StoreVirtual (e.g. Lefthand), or will they fence it in (e.g. being restricted to certain scenarios?

Will the Nimble solution be allowed to move up market into the low-end of where 3PAR has been positioned, perhaps even higher up given its all flash capabilities. Or, will there be a 3PAR everywhere approach?

Then there is Simplivity as the solution is effectively software running on an HPE server (or with other partners Cisco and Lenovo) along with a PCIe offload card (with Simplivity data services acceleration). Note that Simplivity leverages PCIe offload cards for some of their functionality, this too is familiar ground for HPE given its ASIC use by 3PAR.

Simplivity has the potential to disrupt some low to mid-range, perhaps even larger opportunities that are looking to go to a converged infrastructure (CI) or HCI deployment as part of their data infrastructure needs. One can speculate that Simplivity after repackaging will be positioned along current HPE CI and HCI solutions.

This will be interesting to watch to see if the HPE server and storage groups can converge not only from a technology point, also sales, marketing, service, and support perspective. With the Simplivity solution, HPE has an opportunity to move the industry thinking or perception that HCI is only for small environments defined by what some products can do.

What I mean by this is that HPE with its enterprise and SMB along with SME and cloud managed service provider experience as well as servers can bring hyper-scale out (and up) converged to the market. In other words, start addressing the concern I hear from larger organizations that most CI or HCI solutions (or packaging) are just for smaller environments. HPE has the servers, they have the storage from MSAs to other modules and core data infrastructure building blocks along with the robustness of the Simplivity software to enable hyper-scale out CI.

What about bulk, object, scale-out storage

HPE has a robust tape business, yes I know tape is dead, however tell that to the customers who keep buying products providing revenue along with margin to HPE (and others). Likewise HPE has VTLs as well as other solutions for addressing bulk data (e.g. big data, backups, protection copies, archives, high volume, and large quantity, what goes on tape or object). For example HPE has the StoreOnce solution.

However where is the HPE object storage story?

Otoh, does HPE its own object storage software, simply partner with others? HPE can continue to provide servers along with underlying storage for other vendors bulk, cloud and object storage systems, and where needed, meet in the channel among other arrangements.

On the other hand, this is where similar to Polyserve and Ibrix among others in the past have come into play, with HPE via its pathfinder (investment group) joining others in putting some money into Hedvig. HPE gets access to Hedvig for their scale out storage that can be used for bulk as well as other deployments including CI, HCI and CIB (e.g. something to sell HPE servers and storage with).

HPE can continue to partner with other software providers and software-defined storage stacks. Keep in mind that Milan Shetti (CTO, Data Center Infrastructure Group HPE) is no stranger to these waters given his past at Ibrix among others.

What About Hedvig

Time to get back to Hedvig which is a storage startup whose software can run on various server storage platforms, as well as in different topologies. Different topologies include in a CI or HCI, Cloud, as well as scale out with various access including block, file and object. In addition to block, file and object access, Hedvig has interesting management tools, data services, along with support for VMware, Docker, and OpenStack among others.

Recently Hedvig landed another $21.5M USD in funding bringing their total to about $52M USD. HPE via its investment arm, joins other investors (note HPE was part of the $21.5M, that was not the amount they invested) including Vertex, Atlantic Bridge, Redpoint, edbi and true ventures.

What does this mean for HPE and Hedvig among others? Tough to say however easy to imagine how Hedvig could be leveraged as a partner using HPE servers, as well as for HPE to have an addition to their bulk, scale-out, cloud and object storage portfolio.

Where to Learn More

View more material on HPE, data infrastructure and related topics with the following links.

Cloud and Object storage are in your future, what are some questions?PCIe Server Storage I/O Network FundamentalsIf NVMe is the answer, what are the questions?Fixing the Microsoft Windows 10 1709 post upgrade restart loopData Infrastructure server storage I/O network Recommended ReadingIntroducing Windows Subsystem for Linux WSL OverviewIT transformation Serverless Life Beyond DevOps with New York Times CTO Nick Rockwell PodcastHPE Announces AMD Powered Gen 10 ProLiant DL385 For Software Defined WorkloadsAWS Announces New S3 Cloud Storage Security Encryption FeaturesNVM Non Volatile Memory Express NVMe PlaceData Infrastructure Primer and Overview (Its Whats Inside The Data Center)January 2017 Server StorageIO Update NewsletterSeptember and October 2016 Server StorageIO Update NewsletterHP Buys one of the seven networking dwarfs and gets a bargainDid HP respond to EMC and Cisco VCE with Microsoft Hyper-V bundle?Give HP storage some love and short strokinWhile HP and Dell make counter bids, exclusive interview with 3PAR CEO David ScottData Protection Fundamental Topics Tools Techniques Technologies TipsHewlett-Packard beats Dell, pays $2.35 billion for 3PARHP Moonshot 1500 software defined capable compute serversWhat Does Converged (CI) and Hyper converged (HCI) Mean to Storage I/O?What’s a data infrastructure?Ensure your data infrastructure remains available and resilientObject Storage Center, The SSD place and The NVMe placeAdditional learning experiences along with common questions (and answers), as well as tips can be found in Software Defined Data Infrastructure Essentials book.

What this all means

Generally speaking I think this is a good series of moves for HPE (and their customers) as long as they can execute in all dimensions.

Let’s see how they execute, and by this, I mean more than simply executing or terminating staff from recently acquired or earlier acquisitions. How will HPE craft go to the market message that leverages the portfolio to compete and hold or take share from other vendors, vs. cannibalize across its own lines (e.g. revenue prevention)? With that strategy and message, how will HPE assure existing customers will be taken care, be given a definite upgrade and migration path vs. giving them a reason to go elsewhere.

Hopefully HPE unleashes the full potential of Simplivity and Nimble along with 3PAR, XP7 where needed, along with MSA at low-end (or as part of volume scale-out with servers for software defined), to mention sever portfolio. For now, this tells me that HPE is still interested in maintaining, expanding their data infrastructure business vs. simply retrenching selling off assets. Thus this looks like HPE is interested in continuing to invest in data infrastructure technologies including buying into server, storage I/O network, hardware, software solutions, while not simply clinging to what they already have, or previously bought.

Everything is not the same in data centers and across data infrastructure, so why have a one size fits all approach for organization as large, diverse as HPE.

Congratulations and best wishes to the folks at Hedvig, Nimble, Simplivity.

Now, lets see how this all plays out.

Ok, nuff said, for now.

Gs

Greg Schulz – Microsoft MVP Cloud and Data Center Management, VMware vExpert 2010-2017 (vSAN and vCloud). Author of Software Defined Data Infrastructure Essentials (CRC Press), as well as Cloud and Virtual Data Storage Networking (CRC Press), The Green and Virtual Data Center (CRC Press), Resilient Storage Networks (Elsevier) and twitter @storageio. Courteous comments are welcome for consideration. First published on https://storageioblog.com any reproduction in whole, in part, with changes to content, without source attribution under title or without permission is forbidden.

All Comments, (C) and (TM) belong to their owners/posters, Other content (C) Copyright 2006-2026 Server StorageIO and UnlimitedIO. All Rights Reserved. StorageIO is a registered Trade Mark (TM) of Server StorageIO.

![]()

![]()